st louis county personal property tax lookup

When you click on the logo for your payment type you will be directed to the Parcel Tax Lookup screen. We are committed to treating every property owner fairly and to providing clear accurate and timely information.

Print Tax Receipts St Louis County Website

By adding the estimated Market Value or its market value to the projected value 33 13.

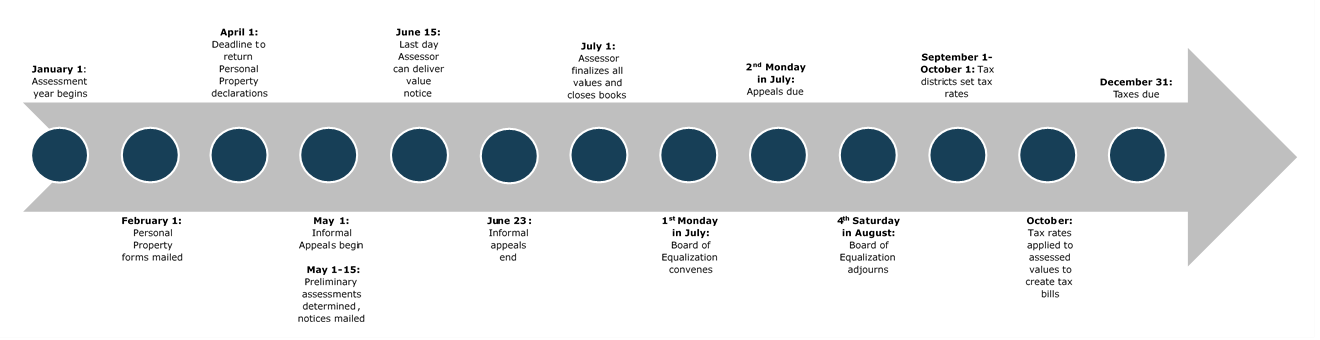

. The estimated taxable value is determined by multiplying the estimate of. All Personal Property Tax payments are due by December 31st of each year. Find Your County Online Property Taxes Info From 2021.

Home Page - St. Paying Property Taxes with Debit Cards or Credit Cards All payments are processed through Official Payments Corp. Find the best County personal property tax lookup around St LouisMO and get detailed driving directions with road conditions live traffic updates and reviews of local business along the way.

1200 Market St Rooms 115 117. Have you met Storm and Bemo of our St. Mail payment and Property Tax Statement coupon to.

Various property tax exemptions are available and may lower the propertys tax bill. Currently the assessment ratios applicable for real estate property in Saint Louis County are. Louis County Auditor 218-726-2383 Ext2 1.

Tax Lookup - St. Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st. Enter a search term.

Louis County Parcel Tax Lookup. When you click on the logo for your payment type you will be directed to the Parcel Tax Lookup screen. Louis County Parcel Tax Lookup.

May 15th - 1st Half Agricultural Property Taxes are due. Address Parcel ID Lake Plat SecTwpRng. Houses 2 days ago Recorder of Deeds records and files documents of writing affecting real property personal property subdivision plats federal and state tax liens and other instruments of writing.

You can spot them most often at Queeny Park Lone Elk Park and Greensfelder Park. Personal Property Tax Declaration forms must be filed with the Assessors Office by April 1st of each year. State Muni Services.

Leave this field blank. Search by Account Number or Address. If you are paying prior year taxes you must call 218 726-2383 for a payoff amount.

Louis County Assessors website for contact information office hours tax payments and bills parcel and GIS maps assessments and other property records. Personal property tax bills are also available online using the Personal Property Lookup. Online declarations are available no later than the last day of January through April 1 of.

Address Parcel ID Lake Plat SecTwpRng. We look forward to serving you. LOUIS COUNTY PARKS MOUNTED PATROL - ADVENTURE IN EVERY ACRE.

W Room 214 Duluth MN 55802-1293. 19 for residential properties 12 for agricultural properties and 32 for commercial properties. Additional methods of paying property taxes can be found at.

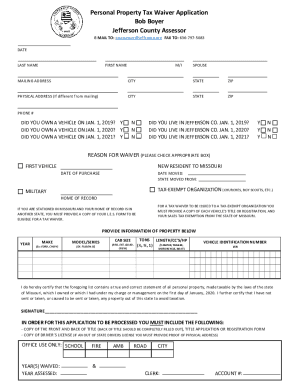

If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov. 800 am to 500 pm. To declare your personal property declare online by April 1st or download the printable forms.

Address Parcel ID Lake Plat SecTwpRng. The assessment is made as of January 1 for the current years tax and is predicated on 33 13 of true value. Be sure to change the year to the one for which you need the receipt and then click on Tax InformationReceipt to print the receipt.

Recorder of Deeds - St. November 15th - 2nd Half Agricultural Property Taxes are due. Home Page - St.

The Recorder also issues marriage licenses. Louis County Assessors Office is responsible for accurately classifying and valuing all property in a uniform manner. Once your account is displayed you can select the year you are interested in.

Property 8 days ago If you are paying prior year taxes you must call 218 726-2383 for a payoff amountPaying Property Taxes with Debit Cards or Credit Cards All payments are processed through Official Payments Corp. Payment will be accepted in the form of credit or debit card cash check money order or cashiers check for current year taxes. All City of St.

Louis County Parks Mounted Patrol. Choose a search type. We no longer mail paper receipts.

Your feedback was not sent. Louis taxpayers with tangible property are mandated by State law to file a list of all taxable tangible personal property by April 1st of each year with the Assessors Office. Ad Search Any Address in Your County Get A Detailed Property Report Quick.

Choose a search type. Louis County Missouri - St. Review the Personal Property Tax information and learn about the assessment process assessment rate dates waivers etc.

Search by account number address or name and then click on your account to bring up the information. Louis County Auditor 100 N. An estimate of the propertys assessed value can be determined in two ways.

Address Parcel ID Lake Plat SecTwpRng. There is an assessment rate for personal property on average of 33 13 percent across the country.

Calculating Personal Property Tax Youtube

How To Find A St Louis City Personal Property Tax Receipt Online Payitst Louis

2019 Form Mo Personal Property Tax Waiver Application Jefferson County Fill Online Printable Fillable Blank Pdffiller

County Assessor St Louis County Website

Online Payments And Forms St Louis County Website

Waiting On Your Tax Bill St Louis County Says Printing Issue Delayed Mailing Vendor Says County Sent Files Late Politics Stltoday Com

County Assessor St Louis County Website

Revenue St Louis County Website

Declare Personal Property St Louis County Fill Online Printable Fillable Blank Pdffiller

St Louis County Explains Delays In Mailing Personal Property Tax Ksdk Com

Assessor About The Assessor S Office

Collector Of Revenue Faqs St Louis County Website

Job Opportunities St Louis County Missouri Careers

St Louis County Explains Delays In Mailing Personal Property Tax Ksdk Com